Gratitude Journals: Why you need to start one now

In this hustle and bustle world, it’s easy to feel overwhelmed, stressed, and unhappy. We have so much to juggle as young adults, from work to relationships to health. When you’re always on the go from the time you wake up until you go to bed, your life can feel like it’s no longer yours.

And constantly striving for something more can create feelings of toxic competitiveness. That’s where keeping a gratitude journal comes in. Taking a few minutes each day to jot down things you are thankful for can help you feel like you have reclaimed your life.

Noticing the little things really is key to happiness! In this post, I’ll let you in on how to start your own gratitude journal and all the amazing benefits that come with it. Let’s go!

***This article contains affiliate links, and we will be compensated for any purchase made by clicking on them. Thank you for supporting Miss Millennia Magazine!***

What Is A Gratitude Journal?

It’s just human nature to focus on the negative. You may have had an awesome vacation but only remember that it rained one day you wanted to hit the beach. Or you get your grades back and worry about your one C instead of celebrating all your A’s. This bad habit leads us to always be reaching for something more.

We think that if we just had a different job or lived somewhere else or didn’t have health problems that we would be happy. Then we achieve those things but keep wishing for something else to change. That’s where practicing gratitude comes in. By focusing on all the wonderful things you do have in your life instead of the things you don’t, you can feel calmer, happier, and more positive toward others.

With mental health, self-care, and organization all becoming trendy these days, you have probably heard of lots of different kinds of journals. Each one is designed to help get at least one aspect of your life together so you feel calm, happy, and like a better adult.

Gratitude journals are arguably the easiest type of journal to write and maintain. There are lots of different formats you can purchase, but it’s easier to start simple. At the end of every day, jot down 5 things you are grateful for. That’s it! They can be big things (your family), small things (a yummy ice cream cone), things specific to that day (perfect weather for your beach trip), or timeless things (your favorite band).

While just thinking positive thoughts is a step in the right direction toward gratitude, a gratitude journal makes these feelings more concrete. There is something about physically writing things down that helps cement them in our minds and commit them to memory. Other great examples of this are drafting a grocery list on paper or rewriting notes when studying for an exam. Writing out all the things you are thankful for at the end of the day makes a deeper impact on your happiness and stress levels than simply reflecting in your mind.

Gratitude Journals Have Major Mental Health Benefits

According to an article in the Huffington Post, writing in a gratitude journal regularly comes with major benefits. Recording the things you find noteworthy from each day helps you learn more about yourself, a great step towards self-awareness and feeling more in control of your own life. This process also brings clarity about your intentions for your own life. For instance, things you never say you are grateful for can probably be cut from your life, while things you often write down in your gratitude journal should get more of your time and attention.

Gratitude journals make an affordable alternative to therapy, as they are a safe space to express your feelings free of judgment. Plus did you know that reducing your stress levels can actually boost your immune system? Reflecting can literally heal you, body, mind, and soul!

That’s not all.

The effects of gratitude on the brain are crazy amazing, too! Taking time to feel thankful for things can put even the worst day in perspective and helps you appreciate everything you have. You literally think yourself into a good mood! Don’t get me wrong; you are still allowed to feel angry, sad, or stressed out. But remembering the positive aspects of your life is a simple and natural way to reduce the effect of those bad feelings.

This good habit has been shown to reduce stress and anxiety, improve sleep quality, and even increase focus. When you are constantly on the go, taking a few quiet minutes each day to really become aware and mindful of what’s going on around you helps you feel calm and in control.

Best of all?

Feeling happier and more optimistic makes you treat others better, improving personal relationships and making you more likable overall. You can learn more about all the awesome gratitude journal benefits you can experience in the video below.

It’s Easy To Start Your Own Gratitude Journal

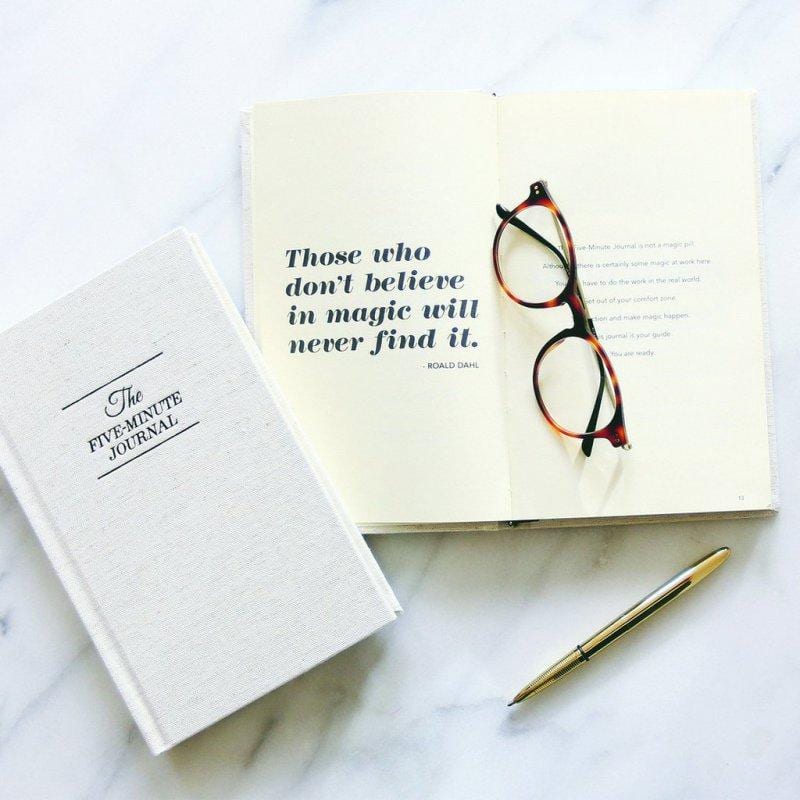

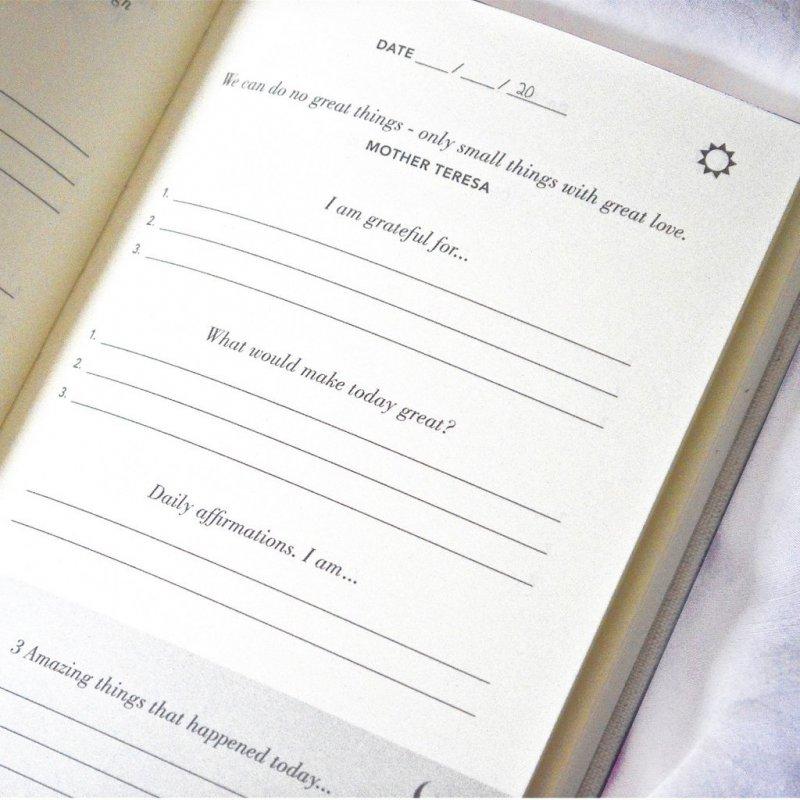

If you have committed to keeping a gratitude journal but don’t know where to start, check out The Five Minute Journal. This handy tool has daily pages with both morning and night exercises already printed inside. The morning sections let you list 3 things you are grateful for, 3 things that would make that day amazing, and a place for personal affirmations. Then, at night, you can add 3 awesome things that happened that day and ways that the day could have gone even better.

Each page also comes with an inspirational quote to motivate you to be your best! Having an actual journal already printed with prompts is the easiest way to ensure you’ll stick with it. There’s nothing else you can use it for and a lot of the work is already done for you! Pick up your copy of The Five Minute Journal here.

You can also start out a little slower by creating your own gratitude journal from a simple notebook. At first, try sitting down on Sunday night and thinking back on the week. Then, write down the 5 things you are most thankful for in as much detail as possible. The deeper you think about the things you are grateful for, the happier you’ll feel! Once you get into the habit of reflecting, increase the number of times you write in your journal each week. The goal is to journal every day for ultimate happiness!

The best part?

Completing your daily entry takes just a few minutes! So even if you feel super swamped, this is a good habit you can find time for. Take out your gratitude journal on your commute home, while you are waiting for the oven to preheat, or before bed.

Personalize Your Gratitude Journal

Everyone’s idea of the perfect gratitude journal does not look the same. For instance, some people love the feeling of a physical pen and paper in their hand. I’m totally that kind of person. Writing by hand makes me feel more connected to the content I’m writing, plus I love using cute stationary items.

For others, though, an electronic gratitude journal makes more sense. If you live on your laptop or phone anyway, journaling on your device might feel more natural and easier to remember to do. Those who don’t like writing might resist keeping a gratitude journal in a notebook, but it might feel more enjoyable simply by using your notes app instead.

Setting up your gratitude journal in a way that makes sense to you will also ensure you stick with it. If you’re like me and love structure and rules, try using a template or pre-made journal like The Five Minute Journal. For more creative types, grab a blank notebook and let your imagination soar. You can change up the number of items you’re thankful for each day, how much you elaborate on them, and how each day’s page is set up. You can add your own inspiring quotes or cute decorations to increase your happiness even more.

You’re not a kid in an elementary school class anymore, so you aren’t forced to make your journal look any certain way. It’s up to you! The more you personalize, the more motivated you will feel to write in it every day.

You don’t even have to write in your gratitude journal every day if you don’t want to! If jotting down the things you are grateful for once a week fits your schedule better, do it that way. Gratitude journals are supposed to help you feel calm and joyful.

So if journaling ever starts making you stressed out, change up your ritual! Paring your writing time with a warm cup of tea, a hot bath, or your favorite music can help get you into the right frame of mind. Training your brain to associate journaling with relaxation and happiness definitely helps make it become a long-term habit.

Make Your Gratitude Journal Work For You

One of my favorite gratitude journal ideas is to not let old entries just sit there. Whenever you are feeling extra sad, take a look back on things you were thankful for in the past. This is likely to trigger happy memories and help you remember that life isn’t all doom and gloom. You can also read through your gratitude journal at the end of each year, noting the changes that happened in your life in the past few months and reliving the highlights.

Here’s the thing.

Keeping a gratitude journal is crazy easy but you have to keep up with it to reap the benefits. If you’re like me, you probably get really gung-ho about things when you first start them and then kind of taper off after a few weeks. It happens to everyone! You might miss an entry because you got home late or forget to write while you’re on vacation. After missing a few, it often feels easier to just give up than to get back in the writing habit again.

But keep trying! Everyone has 5 minutes in their day to reflect, so choose a quiet moment to really think about your life. You will feel so much more present in your own life–a key step toward stress relief and happiness.

Long before it became a trend, Oprah (yes, the queen of us all) kept a gratitude journal. In this essay, she shares how important showing gratitude is to her life. Upon reading her old journal entries from the 90s, Oprah shares that she had not only slacked off in writing daily but also in finding joy in the small things in life. Even though her empire has grown enormously since then but somehow her happiness had not followed suit.

Now she’s taken up gratitude journaling again and feels much happier, focusing on all that she has achieved rather than the stress and hard work that comes with it. If one of the busiest women in the world can keep up with journaling, so can you!

So Give It A Try!

Who knew that reflecting for just a few minutes each day could have such a huge impact? If you are constantly feeling sad or stressed, try writing in a gratitude journal for just one month. It will definitely impact your mental health in a positive way!

And no matter how crazy busy your schedule is, you have the time for it. Gratitude journaling only takes a couple of minutes each day! If it’s good enough for Oprah, it’s good enough for me. Grab your favorite cozy blanket, put on some soothing music, and get writing.

Do you keep a gratitude journal? What are your favorite tips for sticking with it? Do you make any cool additions to your journal? Let us know in the comments below!

Resources:

The Benefits of a Gratitude Journal and How to Maintain One

How To Gratitude Journal for Mindfulness, Better Sleep, and Positive Thinking

What Oprah Knows For Sure About Gratitude