How to File Your Taxes for the First Time

Ugh, taxes. Literally one of my least favorite things to do. In fact, I can’t think of a single person who has enjoyed doing taxes. And rightfully so. We all have that dread that we will make that one wrong move or accidentally forgetting to add some information. BOOM! You are being audited. Ok maybe it’s not that dramatic but it can definitely be scary. It’s even scarier if it is your first time filing your taxes on your own. Well, you have nothing to fear. If millions of people do it every year, then you are perfectly capable of doing it as well. Plus, I have come up with a list of ways to make it through your first solo tax season and to file your taxes for the first time.

*This article contains affiliate links, and we will be compensated for any purchase made by clicking on them. Thank you for supporting Miss Millennia Magazine!*

Let Your Parents Know

I know this one seems silly but be sure to let your parents know you are filing your taxes this year. Unless your parents have told you enough is enough and it’s time you started doing your taxes, they may assume they are doing them. This can cause issue’s because you cannot claim tax exemptions if you are dependent. This gives you a better chance of getting a tax return. So it is imperative that you let your parents know you are filing as a dependent. My parents had already begun working on my taxes before I told them I would be flying the coup and doing it myself. Make this your first step!

Begin Early

Now I know what you are asking yourself after reading that subtitle. “Why would I want to start something early that I am already dreading doing?” Trust me on this one. It will be 10 times worst to prolong beginning your taxes and saving it to the last minute. I am a huge procrastinator; however, it is something I am working on this year. So when confronted with something as important as your taxes, it’s not something you want to procrastinate doing. You can make your life so much easier by starting to collect your papers now, versus late March. This way you can also ask any questions you may have. And trust, you will have plenty of questions.

What paperwork will you be needing? Well, you will need to collect all of your W2’s from every job you’ve worked in that past year. Be sure to think back to the very beginning of the year. I know that while I was in college, I had so many odd jobs that I would often forget some until the W2 showed up in my mailbox. So it will make it easier to recall any jobs if you look back through a planner or calendar and think of what you were doing each month. You can’t just rely on old employers to remember to send you your W2’s. There have been many times I have had to reach out to have them send it. What’s convenient is that most employers start sending them out at the beginning of the year.

Not only do you need W2’s but also 1098’s from your university if you’re still in school. Being in school can potentially help you to get a higher return. “If you’re going to school — and paying for it — you can opt for certain deductions when filing your tax return. A deduction reduces the amount of tax taken out of your paychecks, and education deductions can save you as much as $4,000” (Nerd Wallet). It is important that as a first-time tax filer you do not overlook anything that can help you out in the long run.

Do Some Research

Speaking of being on the lookout for helpful tips: do some research. “New taxpayers should make sure they do not leave money on the table by overlooking tax deductions” (Nerd Wallet). It’s understandable that having to file your taxes for the first time can be tricky and overwhelming to research. The IRS webpage does not incite feelings of excitement or joy. But there are so many little helpful articles and website that are made to help you out *cough* like this article *cough*.

TurboTax is Bae:

Now I’ve only given you some tips on how to get started and why you should start now. I haven’t really gone into depth on how you file your taxes for the first time. It’s a bit more complicated than just compiling your W2’s. For that, you will need a bit more help. I know there are thousands of companies out there that would help you file your taxes for the first time. Some cost a butt ton and others may be free. But you definitely want to work with someone that is guaranteed to help you and not charge an arm and a leg.

Well, let me tell you about the greatest tax software in the world. TurboTax. Just like the subheading says TurboTax is bae. If I could spend every article writing about them I would because they are amazing. TurboTax helps you do your own taxes but also has experts available for chat 24/7 to answer questions and provide advice so you can continue filing confidently. And I’m not talking about some robotic answers. No! You are getting live human help, on-demand so that you are not alone in this process. TurboTax empowers YOU to take control of your finances –starting with your taxes!

My parents have been using TurboTax for as long as I can remember so when the time came for me to do it, I figured I would keep the tradition going. I remember logging on and being so nervous to actually start. The first thing that popped up was something along the lines of “Hello! How do you feel about doing your taxes today?” and then there was 3 options of an excited, unfazed or nervous face. I, of course, chose the nervous face and a screen popped up saying “We understand but we’re here to help”. I immediately felt better about filing. Throughout the entire process, I felt that I was truly supported and no question would be scoffed at (because I definitely had some dumb ones). So when I say they empower you I truly mean it.

Tackling the Complex

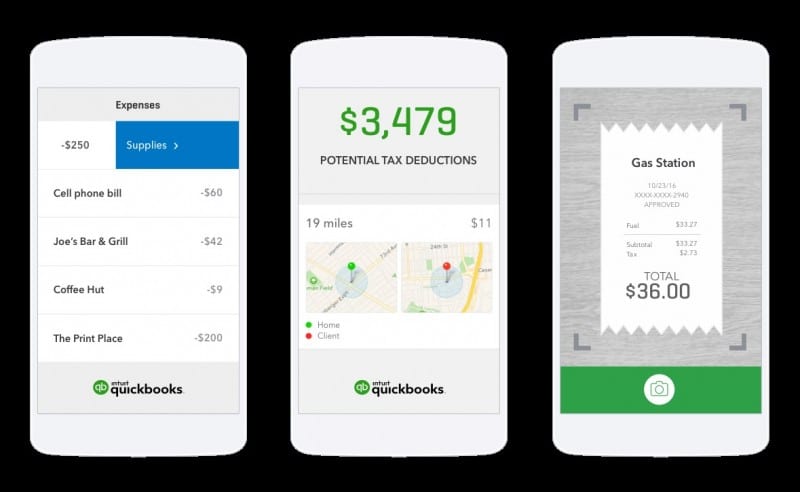

Usually, if you are a first-time filer, your taxes shouldn’t be too complicated. However, if you have your own business or have like an Etsy store, it can get a bit trickier. This is also another reason you should get a head start now. Waiting until the last second to handle a situation you have never dealt with before can be stressful. TurboTax offers features that can handle any complex situation. So for instance, if you do have your own business or something like that, there is a feature called TurboTax Self-Employed. This offers a year-round integrated tax preparation and expense tracking solution designed specifically for the unique needs of the self-employed workforce. You can connect with a credentialed tax expert who specializes in self-employment taxes to get answers to your questions whenever you need it, even if you have multiple sources of income. All of this at no additional cost!

How Much to Pay

As a first-time filer, I would suggest using some type of company to file with versus filing completely on your own. A company can catch any mistakes or things you would not have thought of. In fact, I would suggest using it for the first couple of times until you really get the hang of it. However, by that time you may be so in love with having someone else do it, you will never go to doing it on your own. Now as to what you should pay.

Here’s the deal.

You may think that because this is such an important ordeal, you will have to pay a huge amount to have your taxes filed properly. This is definitely not the case. There are many companies that will do it for free or a very low price. Now I know what may be going through your head. The age-old adage “you get what you pay for”. And while that may ring true for most things, there are still many companies that will not charge you much. One would be TurboTax (surprise surprise). You can actually file with them for free! It’s only if you have a more complex filing that they may charge a small fee. And even with that, you can choose to take the charge out of your refund money.

Accessibility

With all this talk of price and quality, you should also work with someone that is easily accessible and allow you to access your information at any given time in one place. I found myself getting up at 3 in the morning fretting over my taxes and wanting to ask pressing questions. So you want to find someone that is there for you for all the crazy questions. Hmm, what company could possibly offer you that? Surprise surprise I’m going to say TurboTax again.

Their level of accessibility is unreal. While also being able to access your tax information from your computer, you can also do it right from your phone. TurboTax has a mobile app – available for iOS/Android, on both phones and tablets – that offers the full line-up of TurboTax products – anytime, anywhere. The app has a virtual assistant to help you easily view and search FAQs, and ask questions on the go via a simple, conversational, text-like user experience so that you can get answers to your questions. You can even snap a picture of your W-2 with your phone or tablet, verify the data and TurboTax securely puts your information into the right tax forms without hassle or worry, regardless of whether you started from a phone, tablet or computer. Y’all, it doesn’t get any better than this!

That’s not all…

There is even a screen sharing option! Screen sharing capability allows the TurboTax expert to guide customers while answering questions by circling information and highlighting next steps right on the screen so they can file with confidence!

Double Check

By accessing companies like TurboTax to help you with your taxes, you are also given the chance to double check that everything is correct and in order before filing. This is an attribute you want any company you are working with to have. TurboTax’s is called CompleteCheck. It delivers a comprehensive and streamlined review of your return, checking for missing, incomplete or conflicting information and guiding you to easily fix errors before filing. CompleteCheck then lets you know your return is ready to file, giving you the confidence that your tax return is done right!

How lovely it is to have someone that has got your back and double checking your work to make sure you file correctly and maximize your refund. This is something you can not/ should not let slip by you as a first-time filer. You are almost guaranteed to miss something or forget some detail as it is your first time. That’s ok and perfectly normal. But it is extra comforting to know that a company is there to ensure those mistakes do not cost you in the end.

Get Return Early

The best part?

If you follow all of these steps and, as mentioned before, get an early start on it, then you are guaranteed an early refund check. Now I don’t know about you, but I love getting money! Especially ahead of schedule. As a first-time filer, this will feel like a treat for all the stress you went through with filing your taxes for the first time. When I first started doing my taxes, I was under the impression that if you did your taxes early, you still had to wait until the deadline to get your refund. But no. You can be rewarded even sooner!

All in all, I know that I’ve talked up TurboTax a lot and you may feel that I am just shoving them down your throat. But I honestly put everything behind them because they are that great. I would want you to have nothing but the best experience like I did. However, with that said you can, of course, choose to work with any company you feel fits your needs. I just highly suggest you choose to work with someone versus on your own as a first-time filer. This way you can have a successful first filing. But check out this video on some other helpful tips for first-time tax filing.

Get out there and get filing!

Resources:

Nerd Wallet