Lendtable Review: 401 k Benefits & How To Skyrocket Your Earnings

Does your company offer a 401(k)? If it does, that could mean FREE Money for you—especially if your company matches your contributions. In this article, I will talk about 401(k) benefits and how to make sure you are taking full advantage of yours with the help of Lendtable.

I worked for a company that offered a 401(k) match and always regretted not taking full advantage of it. Primarily because taking full advantage of it would result in taking a pretty significant chunk of my paycheck that I could not afford to lose. The truth is, I had a lot of expenses at the time.

This was my first “big girl job” out of college, which means I had just recently started paying my big girl bills – Bills such as student loans, furniture for my new apartment, and overall just getting used to paying several new bills that I was not precisely accustomed to paying yet.

The idea of putting 6% of every paycheck into a savings account that I would not be able to touch until I turned 59 ½ years old was honestly a laughable thought at the time. However, I still had the stuff to buy, and I needed to build my savings for myself in case of emergencies.

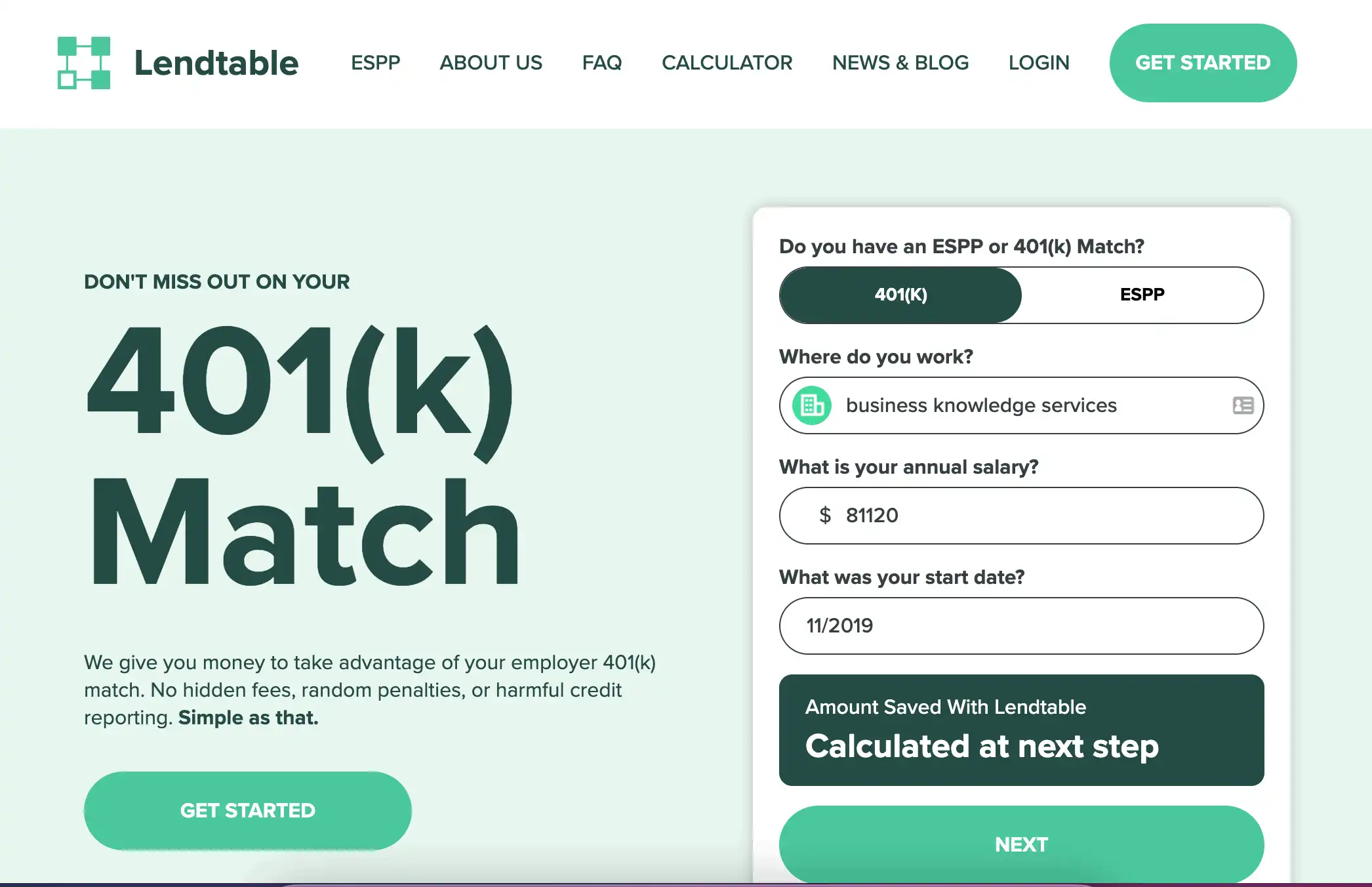

I was thinking of this period in my life when I recently heard about a company called Lendtable. Lendtable makes it easy for people to take full advantage of their 401(k) company match or Employee Stock Purchase Plan (ESPP) benefit. And not only that, their 401(k) contribution calculator will help you figure out how much money you should be putting into your 401(k) to max out your entire 401(k) match.

In this Lendtable review, I’ll cover what I discovered about Lendtable and how to figure out how much money you should be putting into your 401(k) to max out your benefit.

What Is a 401(K) And 401(K) Match?

Before we can talk about how Lendtable can help you grow your wealth passively, we must first understand exactly what a 401(k) is.

It’s tax-deferred

A 401(k) is a retirement savings account that is tax-deferred. This means you don’t have to pay income taxes on what you put away into your retirement account. Hence, you have tax advantaged over your tax bracket.

However, when you’re older, wiser, and hopefully a lot richer, you’ll pay tax on what is withdrawn. So, contribute to your 401 more to take tax advantage on your taxable income.

So, for example, let’s say you make $100,000 a year and have a 22% tax rate. That means your after-tax “take-home” pay would be $78,000. However, if you wanted to put 5% of your income into a 401(k), it would be $5,000 put into your account instead of $3,900 (which is how much it would be after taxes.)

It’s a high-growth account.

Opening a 401(k) also means that you have the option to transfer a portion of your salary to a high-return savings account (on average, this account grows by 7% every year. That’s a lot!) But, again, your contribution limits are well-defined!

Here is the thing about a 401(k) retirement account – it is not a traditional savings account where you can access your funds at any time. You only pay taxes if you withdraw from this account before turning 59 ½. You will face a 10% early withdrawal penalty on top of the income tax already owed on the income statement.

However, this income tax is no different than the income tax you would pay by not contributing in the first place. You can also check out about roth 401 where withdrawals you make after the age of 59½ will be tax-free if your account has continuous funding for a minimum of five years. Roth ira works in a different approach regarding your contributions.

Lendtable Review: Understanding Employer Match

While the pre-tax benefit is one of the perks of having a retirement account, employers who provide matching contributions are even sweeter. What is a company match, you ask?

Your boss puts free money into your account.

According to Investopedia, employer matches of your retirement contributions mean that your employer contributes to your retirement savings plan based on the amount of your annual contribution.

How it works

For example, say you have a salary of $50,000, and your employer offers to match up to 10% of your salary. That means if you contribute $5,000 (10% of a $50,000 salary), your employer will give you an additional $5,000 to invest in your retirement account.

However, if you only contribute $2,000, your employer will only invest an additional $2,000 into a retirement account because they match your contribution up to 10%.

Employee Stock Purchase Plans

This can apply to multiple types of retirement accounts. So not only your 401(k) but also your ESPP. FYI, an ESPP is when a publicly traded company allows you to buy the company stock at a discount at specific intervals to boost your retirement savings.

How to Calculate a 401(K) Contribution From Your Paycheck?

It is always easier for me to understand concepts like these with specific examples. So, let’s consider this scenario:

- Income: $50,000

- Company match: 100% of what you contribute

- Match percentage: 5% of your annual income

This means a couple of things.

- The max your company will match is $5,000.

- That means you must contribute this amount to your 401(k) or ESPP to get the whole “free money” benefit from your employer, which in this case, would be an additional $5,000!

However, if you do not contribute at least $5,000 a year to your 401(k), you leave this free $5,000 on the table.

Use this free calculator to see how increasing your 401(k) contribution could help you get the maximum amount of free match money from your employer. Check out the calculator here.

Lendtable offers a cash advance for you to get the maximum benefit from your 401(k) retirement plan or employee stock purchase plan (ESPP) so that you can create a secure retirement plan. This means you can get the total amount of free money from your employer without having to affect your monthly paycheck. So if you already have budgeted for all of your bills, such as student loans, emergency savings, and we can’t forget about fun! Lendtable makes that possible.

Meeting your company matches each year can be a lot of money for some folks, depending on their expenses and other savings accounts that are more accessible in an emergency.

While saving for retirement is a good thing, it should not negatively affect your paycheck to the point that you can’t afford your monthly expenses. Also, even if you can afford it, maxing out your 401(k) means locking up some funds from your paycheck. Better juncture here. That is where Lendtable comes in.

How Does Lendtable Work?

Lendtable offers a cash advance for you to get the maximum benefit from your 401(k) retirement plan or employee stock purchase plan (ESPP) so that you can create a secure retirement plan.

This means you can get the total amount of free money from your employer without affecting your monthly paycheck. So if you already have budgeted for all your bills, such as student loans, emergency savings, and we can’t forget about fun! Lendtable makes that possible.

This video is an excellent summary of how Lendtable works.

You do not have to worry about paying Lendtable back until your match money is vested. And the best part is you don’t have to worry about missing out on “Free money” from your company without worrying about paying your bills.

I know this is pretty simple, but let’s go over the pros and cons of this service, shall we?

Lendtable Review: Pros of Using Lendtable

No credit check or minimum credit score required

This, to me, was one of the biggest pros of using a tool such as Lendtable.

Unlike student loans and other private loans, no credit check or minimum credit score is needed to qualify for this cash advance. So you can expect to earn more money through your higher contributions without worrying about it negatively impacting your credit score.

No compound interest fees

Not only do you not have to worry about no credit check, but there are no compounding interest fees. Instead, pay what you borrowed, PERIOD, plus a small percentage of your earned free money.

So with credit cards, you pay the original amount you borrowed more than once, depending on how long it takes you to pay off the actual amount you spent.

With a cash advance from Lendtable, you only pay back what you borrowed plus the 5-10% profit split. Pretty cool, right?

Lendtable Review: Cons of Using Lendtable

The Service is Not Free

Initially, I thought the 5-20% profit share was pretty hefty. However, I would take this profit split instead of paying interest rate fees daily. There is no scenario where this loan can get out of hand and cost you thousands of dollars more than what you originally borrowed, like it would if you used a credit card to fund the difference in the account.

Lendtable Review: Is Lendtable Worth It?

Considering the pros and cons of using Lendtable, I would say that Lendtable is most definitely worth it. It is a great resource to get the most money for your retirement without costing you an arm and a leg.

There are no hidden fees, and honestly, there is not much to lose except all the income your company won’t match if you do not sign up for a service like Lendtable.

It did take a bit of research for me to learn more about what they are all about, but it turns out they are an excellent service that will help many reach their highest retirement income!

Lendtable offers a cash advance for you to get the maximum benefit from your 401(k) retirement plan or employee stock purchase plan (ESPP) so that you can create a secure retirement plan.

This means you can get the total amount of free money from your employer without having to affect your monthly paycheck. So if you already have budgeted for all of your bills, such as student loans, emergency savings, and we can’t forget about fun! Lendtable makes that possible.

But that is just my assessment. Check out the testimonials from real users in the videos below.

- Josh talks about how he used Lendtable to get the 401k match from his job at Walmart.

- Or take Daisy, who says her experience with Lendtable has been fantastic!

Overall, Lendtable makes it so simple to max out your 401(k) so that you can rest easy knowing your future retirement is as wealthy as possible.

How Can I Sign Up For Lendtable?

Signing up for Lendtable is easy. Start by completing a quiz to see if you are a good fit for their services here.

Lendtable offers a cash advance for you to get the maximum benefit from your 401(k) retirement plan or employee stock purchase plan (ESPP) so that you can create a secure retirement plan.

This means you can get the total amount of free money from your employer without having to affect your monthly paycheck. So if you already have budgeted for all of your bills, such as student loans, emergency savings, and we can’t forget about fun! Lendtable makes that possible.

Lendtable will let you know how much you could make and give you a full breakdown of what to expect!

Want to learn more about Lendtable? Check out a few of these frequently asked questions and their answers below.

Lendtable Review: FAQs

Concluding Lendtable Review

Take this quiz to see if Lendtable is a good fit for you.

That’s my review of 401(k)s and how you can use a service like Lendtable to take advantage of the “free money” your company offers! I hope it gave you insight into how Lendtable could be an excellent fit for you.