4 Indicators of How Mortgage Rates Affect Slow Down the Market

Mortgage rates are affected by the rate of economic growth, Federal Reserve monetary policy, inflation, and the bond markets. While some of these factors directly affect, others indirectly affect the rates; therefore, as is prudent to monitor these indicators closely as an investor or a home buyer.

The relationship between mortgage rates and house prices

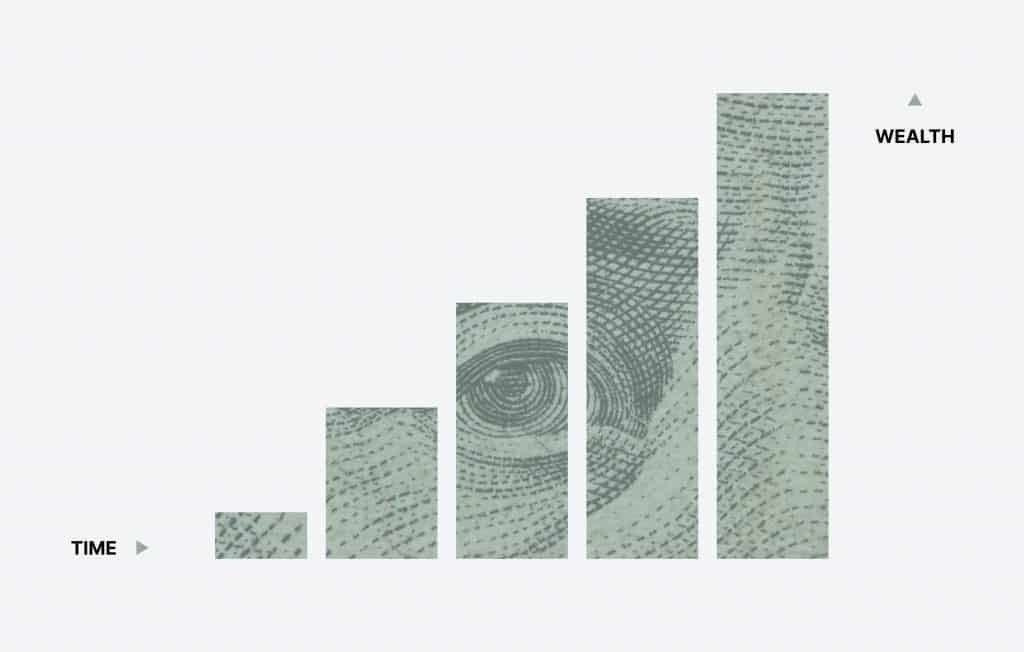

House prices are the critical factors that can affect the housing market and the ability of buyers to afford a home. When interest is low, it becomes cheaper for buyers to borrow money to finance the purchase of a home. This can lead to an increase in demand for housing, which can drive house prices.

High house prices can lead to higher mortgage rates. When house prices are high, lenders may perceive the lending risk as more significant. As a result, they may charge higher mortgage rates to compensate for this perceived increased risk. High mortgage rates can decrease demand for homes, which can cause house prices to decline.

Factors that affect mortgage rates and how they affect the market

A healthy economy with low unemployment means more people are taking out mortgages. But greater federal regulation and increased inflation can act as brakes on consumer borrowing. Conversely, decreased investor confidence in government debt could lead to lower mortgage rates. Whatever the current state of the economy or Federal Reserve policy may be, these factors play a significant role in determining the trajectory.

This makes them significant players in shaping the housing market. However, some real estate players beat the market. For example, the experts at Evernest property management in Colorado Springs, Boulder, Fort Collins, or any other central area in Colorado have consistently delivered a steady and reliable return on investment through a data-driven approach.

The confluence of the rate of economic growth, Federal Reserve monetary policy, inflation, and bond markets brings about changes in mortgage rates.

#1: Rate of economic growth

As economic activity increases or decreases, mortgage rates will see corresponding changes as demand for mortgages and other loans shifts accordingly. As a result, small economic growth changes can drastically impact their loan portfolios. For this reason, mortgage lenders need to be able to forecast change accurately.

The conditions ranging from commodity prices to government regulations, can fluctuate depending on the economy’s strength. Naturally, this affects the health of the markets. Therefore, investors must remain keenly aware of how any shift in economic growth rate may impact their investments.

#2: Federal Reserve monetary policy

As the Federal Reserve adjusts the fed funds rate, banks are prompted to change their profit margins when lending money. This will affect the qualifying process for borrowers and the rate at which people can obtain a mortgage.

Market forces influence too. As demand for mortgages increases, it can cause mortgage rates to increase as well. Understanding how the Federal Reserve affects housing trends is essential for borrowers seeking a loan.

#3: Inflation

Inflation is a critical economic factor influencing mortgage rates and the overall market. A rise in inflation can lead to an interest rate increase. This rise makes it more expensive for consumers to borrow or take out a mortgage.

On the flip side, when inflation is low and interest rates are low, it creates additional purchasing power for consumers looking to acquire real estate. This leads to an upswing in market activity. Therefore, lenders and investors should keep their fingers on the current inflation trends and adjust their borrowing strategies accordingly.

#4: The bond markets

The prices of bonds are directly proportional to mortgage rates, with increasing demand resulting in higher mortgage rates. Ultimately this makes it more expensive for consumers to purchase a new home. Conversely, mortgage rates may decrease when the bond market weakens and demand decreases.

As the bond markets seesaw between highs and lows, so does the stock market. As a result, any fluctuations in the bond market can wreak havoc upon mortgagers and investors alike.

How mortgage rates will slow down the market

The recent uptick is having a pronounced effect on the housing market. It is making it more difficult for prospective buyers to afford a home, thus decreasing demand and slowing the sales of homes. This also affects builders, who may have fewer people to sell their homes to.

Higher mortgage rates act as an economic barrier for many potential homeowners, forcing them to stay out of the real estate game until interest rates drop again. Fortunately, this means that those already in the real estate game will benefit from being able to enjoy steadier prices on their properties due to less competition.

Conclusion

It is difficult to predict how mortgage rates will impact the housing market. However, it is worth keeping an eye on it to understand how it can affect the market. If you are considering buying a home, speak with a lender to understand your options.