How To Get Started with Real Estate Investing

Thanks, Ruvati, for providing the free sink featured in this article.

If you have ever thought about your financial future and ways to secure it, you probably thought about getting into real estate in one way or another. And if you’ve researched the topic, you’ve probably heard the phrase real estate investing.

I remember the first time I heard about real estate investing.

I was reading an article about Oprah and her hobby of finding real estate properties. My first thought was, if Oprah does this, I must pay attention to it!

I researched and found that many one-percenters swear by real estate investing. As I learned more, finding any wealthy celebrities who didn’t invest in real estate became more difficult.

What is Real Estate Investing?

Real estate investing is the process of collecting multiple real estate properties (residential or commercial) to improve and profit from them, either actively or passively.

It’s more than just buying a house to live in. It’s purchasing other properties for other people to live in. One of the great things about real estate investing is that there are so many ways to do it. You can flip houses, rent condos, and buy complete apartment complexes. But my favorite way is with residential homes that you rent out.

In this article, I will describe in detail how I managed to complete my first real estate investment deal and give you tips for starting your first property.

How I got started

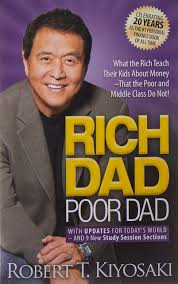

I started real estate investing the same way many people do—by reading a book by Robert Kiyosaki. If the name does not sound familiar, he’s most popularly known for his book Rich Dad, Poor Dad.

He has also written several other books about real estate investing and even invented a game called CashFlow that teaches you how to balance your budget, get out of debt, and invest.

Here is how Robert’s Process works.

- Buy a house with potential.

- Renovate it

- Rent it out

- Get a passive income from your tenant every month

But as I dug deeper into learning this process, I realized that there are 100 other difficult steps that you have to take into account. These include details such as making sure you find the right property, have the correct paperwork, and develop a lease that will protect you in extreme circumstances.

When I heard how many details were involved, I felt quite overwhelmed, so my husband and I joined a real estate investing mentorship group called Lifestyles Unlimited to learn the ropes.

This group outlines all the necessary steps to becoming successful real estate investors and provides numerous resources. Resources include templates for different paperwork, a list of vendors to choose from, realtors specializing in certain properties, classes, webinars, and training to learn more.

My husband and I have heard enough horror stories to want to have an organization like this at our side. This was our first step. We attended weekend classes that taught us all about doing our first deal, leasing, picking a suitable property, and even completing the renovations themselves.

We became members and didn’t look back. One thing they did tell us is that we needed to have at least $15,000 in savings to be able to do this. Saving $15,000 was a challenge since we had both recently graduated from college when we started looking into this. But after a job switch and a few raises, we saved $30,000 for our real estate dreams.

Next, it was time for us to find our first property.

Finding a House

We needed to find the right property. We knew this was an important step, and honestly, it intimidated us quite a bit.

The key to finding an excellent real estate investment property is to find a house that is the worst in a good neighborhood. That gives you enough wiggle room to buy a home at a low cost and still have enough money to do the renovations.

Luckily, the real estate masterminds in our group did much of the due diligence for us and sent us several emails daily for different properties with all the details of how cash flow would flow once all the work was done. One of the realtors from the group told us about one property in particular that he thought would be a good fit for us.

The house was in a decent neighborhood and cost $98,000. It would need about $30,000 worth of work. After accounting for the mortgage, taxes, and all the closing fees, we would need $22,000 out of pocket to complete this deal.

Luckily, this was what we had to work with, so we decided to take the plunge.

Financing

Financing was probably the part that made us the most nervous.

But we felt confident in our membership group. We ended up closing twice on this property.

The first closing was with a hard money lender. The lender will lend you 70% of the after-repair value (ARV), the amount the house will appraise for after you complete renovations.

They send an appraiser to your home who tells you what they think your house will be worth after you make the renovations you say you’ll make. The inspector said he believed it would be worth $147,000 in our case—$49,000 more than our purchase price! An inspector can give you a list of repairs and updates needed to estimate your costs, and construction takeoff services can prepare an estimate for labor and materials.

That meant we initially received $102,900 to purchase the house and make repairs. The catch with a hard money loan is that you have a higher interest rate than a conventional loan, which means you have to be fast with your improvements to pay less interest fees each month. Most investors try to complete their renovations within 30 to 60 days to cut down on interest payments.

Once you finish renovations, you refinance from your hard-earned loan to a conventional loan. You get the same appraiser to your home to look at all the upgrades and tell us if it measures up to the price they initially said it would be. Then, you start the closing process again with a conventional lender.

Renovating

Once we got to the renovation stage, we could relax more. The period between finding the property and closing was only two weeks. It was nice to breathe a little and get excited that we were doing this!

But our work was cut out before we could get a renter in this house.

We had to get a new roof, change the kitchen cabinets, new countertops and sink, new tile and cabinets in the bathrooms, new toilets, fresh paint on the interior and exterior of the home, a new furnace, new light fixtures, and hardware, new washer and dryer connections, and new windows.

Luckily, Chris works in the home building industry and knows how to do many things. And for those he did not do himself, he knew who to call! We were also very grateful to our mentorship group for providing us with some vendors, including a general contractor, who helped us with the renovations.

One place we made sure to pay close attention to was the kitchen. My friend Melissa at Everyday Spokane, who recently did a renovation and sold her home, told me to make sure I don’t go cheap in the kitchen. That is the room that wowed people when she showed her home. We kept her words in mind and got new cabinets with quartz countertops and a Ruvati Crushed Granite Sink.

The countertops and sink were an absolute showstopper every time we showed the property. We liked the design so much that we bought a Ruvati sink in a different design for our home, too! You can get one for yourself here on Amazon.

Chris did the washer-and-dryer hook-up in the garage himself, as well as the kitchen and bathroom cabinets. He also changed all the house’s light fixtures and fixed the kitchen wiring. I’ll be honest; Chris did A LOT of the renovations in this house himself. And the best part was that he seemed to have some fun while doing it, which made this experience even more enjoyable.

Once we finished the renovations, the before-and-after photos were like night and day. Our house went from being the worst house on the street to one of the best. We put a for-rent sign-out and started our journey of finding people to rent the property.

Finding A Renter

While Chris managed most of the renovations for our property, I was in charge of finding a renter.

I took photos of all the rooms in the house and put them on the Cozy website. I also posted the pictures on the listing on Zillow and a listing on Facebook Marketplace to ensure I covered all my bases.

I didn’t worry about there being a shortage of renters. However, I soon realized that there was a shortage of qualified renters. Zillow and Cozy offered all applicants background checks and credit checks, which was a big help. The best part was that we did not have to pay for the services as landlords. Potential renters paid a $30 application fee for Zillow to do a background and credit check along with their application.

This process made it easy to decide who was qualified to live in our rental property. We had pretty standard rules, like requiring a credit score of at least 600 and no eviction notices on their credit record. We also said they needed their first month’s rent and security deposit to move in.

We had over 50 applicants for the property, and most did not meet our requirements. Chris and I began to wonder if our requirements were too stringent. However, after speaking to our mentor, she gave us examples of how it could go wrong if we decided to loosen our qualifications.

And they were terrible. Bad. Enough for us to tell people sorry, you don’t meet our requirements even if their sob story made us want to let them stay there.

And then we finally found renters who we loved. They were great on paper and met all of our requirements. They paid the fees, signed our lease agreement, and were ready to move in within a week. We felt so lucky to find the world’s best tenants. They are a young couple looking to rent their first house together…how sweet!

Our Little Hiccup with finding a renter

But then, the unexpected happened. Only a few days after they finally received the keys to move in, they asked us if there was a way to get out of the lease.

The stress of the move had taken a toll on their relationship, and they were breaking up. The ex-couple no longer wanted to move into the house together.

Leasing the property

Chris and I used a lease template provided by our rental mastermind group, so we reviewed the rules on breaking the lease before replying to our new tenants.

If we decided to let them out of the lease, it would be of our goodwill. Technically, they could still be responsible for paying rent, whether they moved into the house or not. We were leaning towards letting them break the lease when we noticed a clause we were so grateful to have included.

If they broke the lease, they would have to pay 80% of one month’s rent to help us find a new renter. They would also be responsible for paying the rent every month until we found someone new.

We informed our tenants about the clause and the amount they would owe for breaking the lease, which was a little over $1,000. They replied almost immediately with so much gratitude that we were shocked. They were so grateful that we allowed them to break the lease in the first place that they weren’t worried about the fee and the rent until we found another renter.

I made the property available on Zillow, Facebook, and Cozy again and had no trouble getting people to view the property only days after we closed our listing online. We got lucky this time around. We got a new couple in the property within 20 days.

We took the amount they owed for breaking the lease out of their security deposit and sent them a check for the rest they paid us. We had a happy renter in the property within a week of signing the new lease.

Conclusions and Takeaways

After everything was said and done, we now have a monthly cash flow of $319 of rental income after we pay the mortgage and other bills for the property. Being a property manager has been pretty low-key. Of course, there’s the occasional maintenance hiccup, but there’s nothing to complain about. Here are a few tips I would recommend for your first property.

Do your research

There are so many ways investing in real estate can go wrong. Find mentors or friends who have done it before and ask questions. Also, find vendors who have done real estate investment deals before. We were incredibly grateful to our representatives and conventional lenders for our hard money since they held our hand the whole way.

Do background and credit checks on tenants.

We met many people we liked, but fewer people qualified to live in our house. Don’t skip this step. Make sure to call previous renters and jobs, too!

Get help

Chris knew what he was doing for many of our renovations, but plenty were where he hired help. And that is okay! Many people can probably do the work faster and better than you, and they may not be as costly as you think. I cannot speak highly enough about Lifestyles Unlimted. If you can join their membership, I recommend you do. It helped us so much.

Are you interested in your first rental property? Here are a few resources you should check out.