5 Low-risk Investment Alternatives To A Savings Account

Savings accounts are typically the safest way to invest your money. Unless someone hacks your account or hyperinflation occurs, there’s almost no way of experiencing a loss. That said, savings typically don’t make a huge return. Interest rates on savings accounts are currently lower than ever. By exploring alternative options, you could make a much higher return.

But just what are some low-risk investment alternatives? Many other investments are much more volatile and have a greater risk of loss. However, there are some that are fairly secure providing that you invest in the right places. Below are just a few low-risk investment alternatives to savings that are worth exploring.

Government & Corporate Bonds

Many government services and corporations like to increase funding by offering bonds. These are essentially loans given to the government or corporations to help with spending. These loans are then paid back to you with interest, leading to a return.

This return is typically quite low, however, it is still higher than a savings account. Bonds are also very secure – unless the government or corporation collapses, you will make back your money.

Certificates of Deposit (CDs)

A certificate of deposit (CD) is an investment option offered by banks and credit unions. Like a savings account, you deposit money into it upfront. However, unlike a savings account, you have to wait a specific period for the CD to ‘mature’ before you can withdraw it. This could be several months to several years depending on the CD terms.

A CD typically accumulates much more interest than a savings account. The longer the duration before you can withdraw, the higher the potential return. Since they are issued by banks and credit unions, you can also rely on them to be as secure as a savings account.

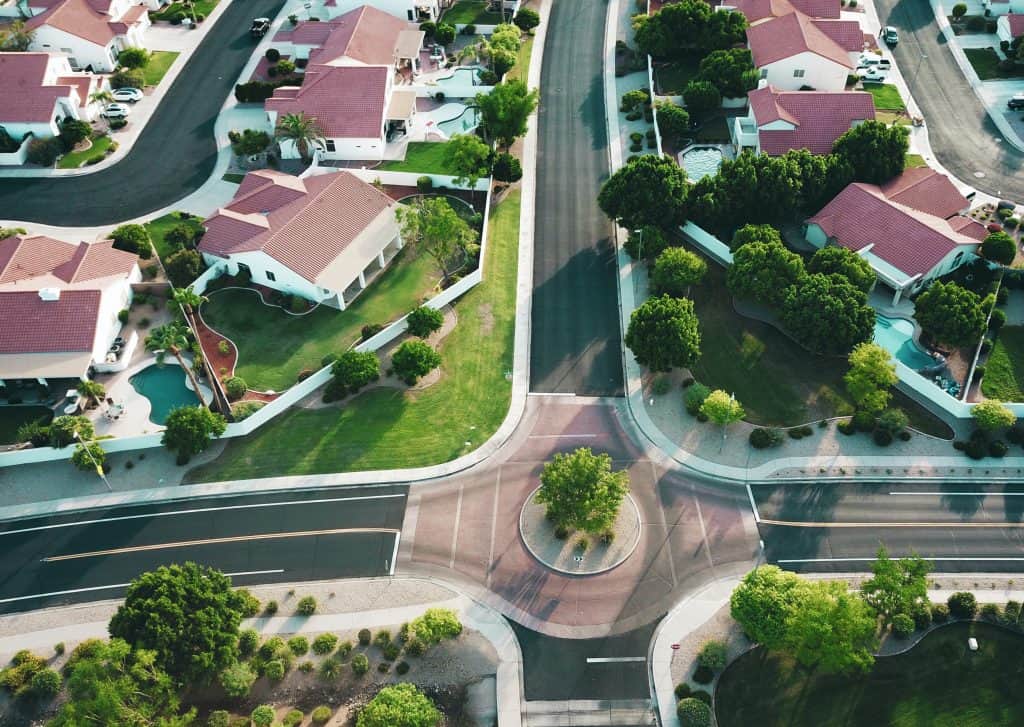

Multi-Family Real Estate

Real estate typically has a lot of risks attached – particularly buy-to-let investments. A tenant could stop paying their rent, you may fail to fill a tenancy vacancy or you could end up continuously paying for repairs. However, you can greatly reduce these risks by considering multifamily real estate.

This is a property that is shared by multiple families each paying rental contributions. It could include anything from a two-family duplex to a property complex shared by hundreds of families.

The more families sharing property, the lower the risk of loss – if one tenant does not pay their rent, there will still be others paying. A multifamily real estate investment company can help you to explore this investment option. In many cases, you have the option of contributing money to other investors. Returns are much better than savings accounts.

Peer-to-Peer Lending

Peer-to-peer lending involves lending money to another individual or company via an online peer-to-peer lending platform. They then pay back the loan to you with interest.

Peer-to-peer lending interest rates are much better than savings accounts. While there is a risk that a debtor will stop making payments, you can reduce risk by carefully choosing who you lend to and by diversifying your investment (lending money to multiple users). Going through a peer-to-peer lending platform is recommended as it gives you a certain level of protection (in some cases, missing payments may even be partially covered).

Low-Risk Stocks

There are lots of risky stocks you can invest in. However, there are also many that are fairly secure. Dividend-paying large companies like Starbucks, Apple, Disney, and Berkshire Hathaway are popular examples that have proven to make a steady return over the years.

There are always periods in which stock prices go down, but such companies tend to always recover because of their size and dominance in the market.

Low-risk stocks typically don’t make as high a return as higher-risk stocks, but will still make you much more money than a savings account. You can secure your investment by diversifying.