5 Things to Save For So They Don’t Ruin Your Finances

We all know we should be saving. After all, it’s the best way to make sure you can afford something you want! It’s important to save for things you want, but there are other things you should save for too.

Instead of pooling all of your savings into a single account that gets drained the next time you go on a trip, create separate accounts for these five things so you have the money for them when you need it.

Medical Costs

No matter how healthy you are now, chances are, you’re going to find yourself at the doctor eventually. Whether you get an illness, like strep throat, that requires a trip to the clinic to get a prescription, you’re expecting a child, or you require a procedure, you could find yourself with medical bills that you can’t afford.

Tens of millions of people don’t have health insurance in the United States, which can make paying medical bills impossible. The first thing you should do is get health insurance so medical bills are lower when you receive them in the mail.

If you have health insurance, you should still put money aside into an account to help pay for what health insurance can’t. A special health savings account is an option, but it’s also okay to start your own savings account and put away a little bit each month so surprise trips to the doctor and medications don’t keep you from going bankrupt.

Home Repairs

Owning a home is a dream of many, but that doesn’t mean it’s a walk in the park when you finally get the keys. Houses require regular repairs over time, some of which can be costly.

Some common home repairs and their costs include:

- Roof: Average of $11,095

- Siding: $6,000-$8,500

- Hot water heater: $300-$900

- Heating unit: Average of $3,865

- Air conditioning: Average of $5,210

Do yourself a favor and start a savings account that can be used for home improvements. That way you aren’t putting off something as simple as a faucet replacement because you can’t afford it.

Car Repairs

Not only will you spend a lot of money on repairs and replacements when you own a home, but you will also fork over plenty of cash if you own a car. If your household owns more than one vehicle, you’ll end up spending even more.

Put money into a special savings account so you always have the cash you need to get the oil changed. Other things your savings can help pay for include:

- New tires: $100-$300 each

- Wheel alignment: $116-$145

- Battery replacement: $299-$311

- Brake pad replacement: $263-$294

- Engine tune up: $150-$1,000

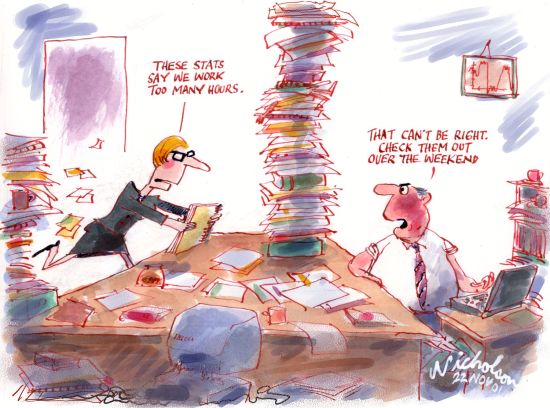

Losing Your Job

You aren’t alone if you rely on your job to pay the bills. Most of us do, which is why it can be so devastating if you ever lose your job.

No matter how secure you think your job is, it’s a good idea to save at least three months’ worth of living expenses so you have a cushion, should anything happen. It’s even better if you can save six months’ worth or even a full year’s worth of living expenses.

Not only can this money help you and your family if you should ever lose your job, but it can also give you the push you need to make a switch. If you know you have a few months’ worths of living expenses saved, you can quit a job you hate without worrying about how you’re going to pay the bills until you find your next job.

Holidays and Birthdays

Did you know the average person spends nearly $1,000 on gifts, holiday items, and other holiday-related expenses during the Christmas season? Where is that money coming from? Hopefully it isn’t coming straight out of your bank account, making it harder to pay the bills!

Put money aside each month to help pay for Christmas presents when the most wonderful time of the year rolls around, but this account can also help pay for other celebrations. Pull money when it’s a friend’s birthday, a family member’s graduation, or a special anniversary.

Don’t wait until you need a little extra cash and hope you have it in your bank account. Plan ahead and create separate savings accounts for these things and you can ensure a medical bill or a car repair doesn’t ruin your finances.