17 Creative Ways To Save Money Online

As unemployment spikes to 14.7% (and counting) in the United States, people are searching for creative ways to save money. The COVID-19 pandemic may serve as a wakeup call, considering only 41% of Americans admitted to having $1,000 available for an emergency—and that study was before COVID-19 arrived!

If your financial situation has changed recently or you are simply using your time at home to discover more ways to save money online, we have you covered. Here are 17 ways to save hundreds (maybe thousands!) of dollars and get that savings account to where it needs to be.

1. Budget

A financial plan without a budget is akin to a workout plan, well, without a plan. Monitoring inflows and outflows are the starting point to any fiscal responsibility. Services like Digit can help users save more money where it counts and pay off debt faster. The app syncs to users’ checking accounts and prioritizes goals accordingly. Sign up with Digit to get your budget on track.

2. Save What You Can

Rather than hitting the coffee shop for a $4 mocha or grabbing a bottle of water for $1 whenever you’re thirsty, do it yourself. Isn’t that what the millennial generation is all about? If you were to enjoy that $4 coffee every day, that would cost $28 per week, or $1,460 over the course of a year. Add in five bottles of water to stay hydrated and that’s an extra $35 weekly, or $1,825 annually. Brewing at home and filling up a reusable bottle could save over $3,000 per year.

3. Review Your Subscriptions

We all fall prey to impulsively buying a subscription to something that seemed like a great idea at the time but has since become irrelevant. Maybe it’s that stack of fitness magazines you’ve been collecting or the second gym membership you forgot you had.

If you relate to this, Trim can help you out. Trim will review your spending habits and help you identify all of your subscriptions, utility bills, old store credit cards, and more and immediately eliminate or reduce what you now deem unnecessary. Sign up with an account today!

4. Enjoy a Staycation

With the country still under strict travel restrictions, the spring or even summer vacation this year might have to be in the backyard. That could be an automatic savings of approximately $4,500 for a family of four. That should be enough for a week of topnotch BBQ’s with plenty of money left to spare.

If you want some amazing staycation ideas, read our article 9 Staycation Ideas For When You Can’t Leave Home!

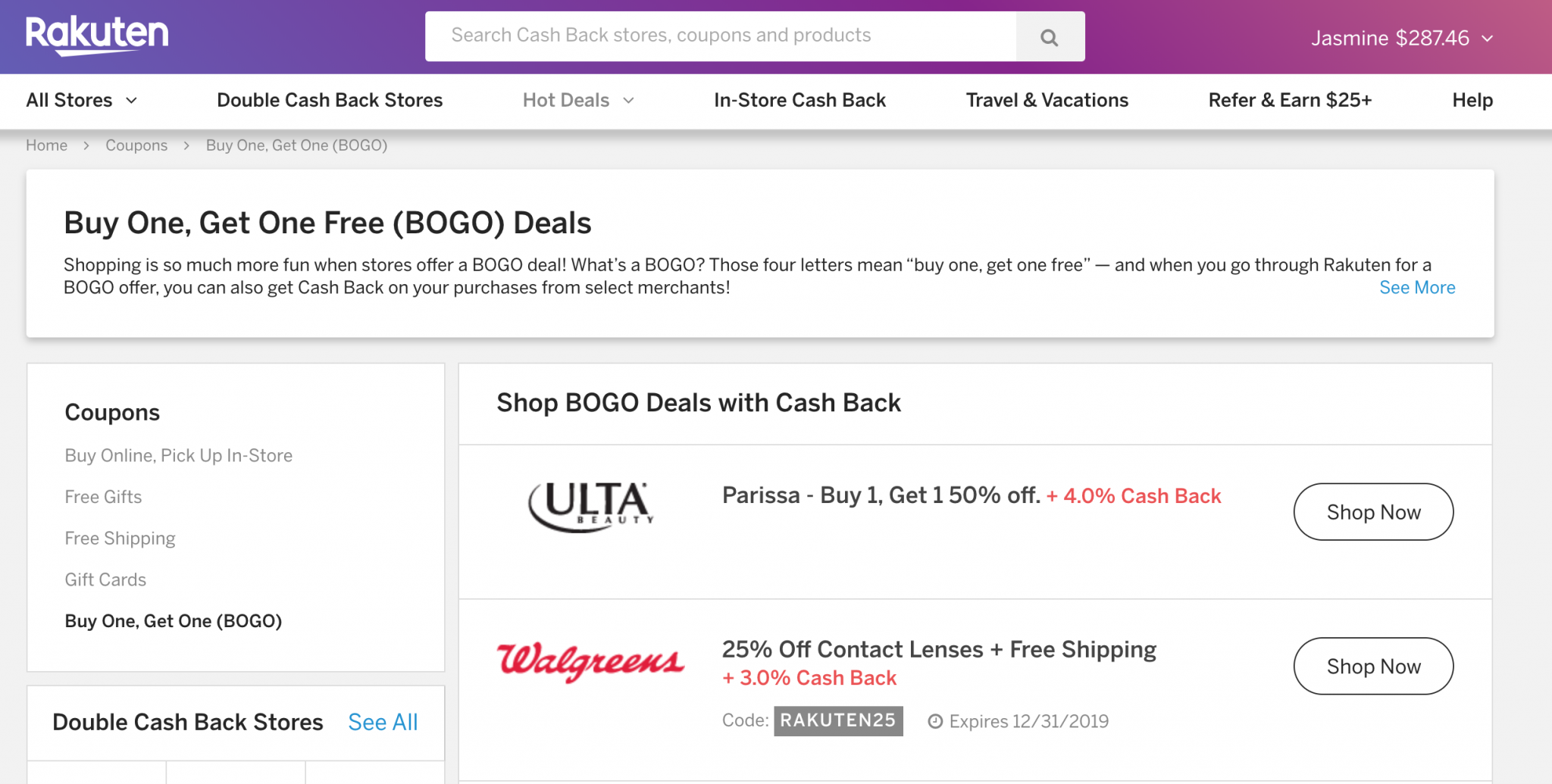

5. Shop With Rakuten

Did you know you can get cashback for shopping at your favorite stores? And I’m not just referring to your rewards credit card.

Shopping with Rakuten (formerly known as Ebates) is one of the most creative ways to save money. With over 1.4 billion members worldwide, they have created a platform geared towards growing gross transaction value and lowering transaction costs. You can pick up coupons and cashback deals at many of your favorite stores online or offline.

Sign up for a free Rakuten account and get cash back with every purchase. Use my link here to get an additional $5!

6. Listen to Music and Podcasts for Free

With services like Amazon Prime, there are literally millions of songs and podcasts to listen to for free. Paying extra to avoid the occasional ad might fall into one of the unnecessary subscriptions we already mentioned above.

7. Stream TV

The list grows every month of providers offering television and movies on demand, including Amazon Prime. With most people getting their news straight from their phones, traditional television is being reserved for sports or other live events. Consider reviewing your television subscriptions and streaming services to see which offer the best value for what you want to watch.

8. Use Coupons

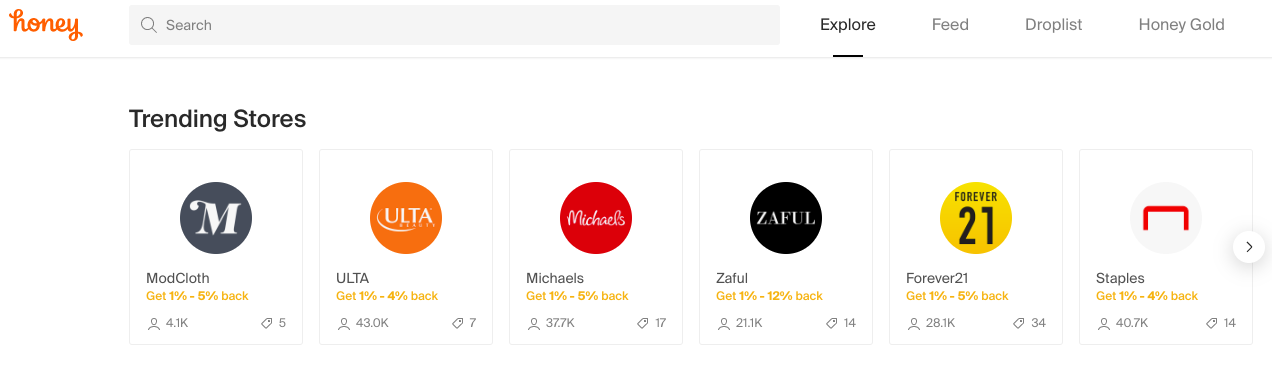

Everyone loves a good deal, and conversely, no one enjoys finding out they were ripped off. Online shoppers can capture the same joy of clipping coupons every week before hitting the grocery store by using Honey.

Honey offers discount codes to thousands of retailers, assuring shoppers they’re getting the lowest price. When you use Honey, it automatically searches all available coupon codes available online and applies the one that saves you the most money. All you have to do is sign up for a free account, check Honey when you shop, and save!

9. Pay Off Your Student Loans, Or Don’t

On March 27, 2020 President Trump signed into law the CARES Act, a part of which offers student loan borrowers relief. Payments will stop from March 13–September 30 this year and will not accrue interest during this period.

Borrowers may reallocate this newfound extra money towards higher interest rate debt such as credit cards. Or if the borrower is debt-free and has healthy savings in their bank account, they may continue to pay down their student loans. 100% of payments will go towards principal during this time.

10. Don’t Give the Kids Your Credit Card

This may sound like common sense, but if you want to save money you can’t spend it. that includes your kids! With the rise of ultra-popular online gaming (such as Fortnite), millions of children are playing “free” games more than ever during social distancing.

However, most of the games have in-game purchases to upgrade their characters, skip levels, or obtain other little perks at an actual monetary cost. Saving mom or dad’s credit card info on the account for a one-time purchase has led to many a kid splurging on extras.

11. Use WiFi

Most phone packages today come with internet. Taking advantage of that is one of the many creative ways you can save money. Using a secure WiFi network in your home or office is an easy way to avoid racking up extra data charges on your cell phone.

Remember to check that you’re connected to WiFi periodically. We’ve all had that time we turned WiFi off when in public, only to forget for the next two weeks that we’ve been operating at home using expensive cell data by accident.

12. Clear Your Cookies

Ever notice how you search one item of interest and then suddenly you are bombarded by similar products for weeks to come? It’s as if those ads on Facebook are reading your mind.

Well, they sort of are. Social media sites like Facebook and Instagram use cookies to personalize the ads you see. You can avoid this, as well as dynamic pricing, by periodically clearing your history and cookies. This way, you will appear as a first-time visitor to the websites you want to shop at.

On the flip side, leaving items in your cart will sometimes trigger sellers to send you discounts and other offers to incentivize you to complete your purchase.

13. Use Google Alerts

Rather than impulsively buying items, exercise some patience to secure that great deal. Anyone can set up Google Alerts to be notified on a topic of your choice. For instance, a user can set an alert for a particular product and a corresponding price, which will then provide notifications with links when it becomes available.

Similarly, Honey offers alerts on sites like Amazon so you can make sure you don’t overpay for the items you want. You can select items on Amazon to track how the price changes in the weeks to come, and Honey will notify you when the price drops. Don’t miss out on all creative ways to save money with Honey!

14. Join Online Store Loyalty Programs

It may seem like a nuisance to take the added ten minutes to complete a survey or profile after you’ve shopped at a store, but it can save you money down the line. Customer loyalty is at the core of any successful company’s mission. One way that brands build loyalty is through offering savings programs.

Signing up for those monthly emails can give you great discounts unavailable to others. Just be careful with the ones that ask you to sign up for their store credit card, as those are the type of subscriptions that can become costly over time.

15. Never Pay for Shipping

There’s really no reason to pay for shipping in 2020. Since Amazon Prime has seemingly taken over the world, other retail giants have fought back with their own free shipping options.

Even smaller retailers that still have shipping costs often offer a “Pick Up in Store” option. It may behoove bargain shoppers to take that five-minute drive to avoid unnecessary costs.

Lastly, many of these sites offer a “Subscribe and Save” feature. If there’s a particular item, say toilet paper, that you know you’ll need regularly, consider a recurring delivery to score a better deal.

16. Decide When To Shop

Every item has its season. Commerce may have become more internet-driven over the past decade, but consumer behavior is still the same. The famous Black Friday sales have been replaced with Cyber Monday, for example. There are many other bargains you can take advantage of that are all based on the time of your shopping.

17. Consolidate Your Online Banking

Many young couples are averse to merging their financial accounts. Doing this often creates a less organized financial plan. Additionally, several institutions still incorporate added fees if bank accounts are not of an adequate amount. Consider consolidating accounts to avoid extra annoying fees.

Use some of your time online to implement these 17 creative ways to save money. Take control of your finances today!

Please subscribe to “The Kuderna Podcast” on any podcast apps and YouTube, or pick up a copy of Millennial Millionaire–A Guide to Become a Millionaire by 30 for more insight.

Bryan M. Kuderna, CFP®, RICP®, LUTCF is the host of The Kuderna Podcast, author of Millennial Millionaire, and founder of Kuderna Financial Team, an NJ-based financial services firm.