Finally, a trusted path to business financing

Get Started

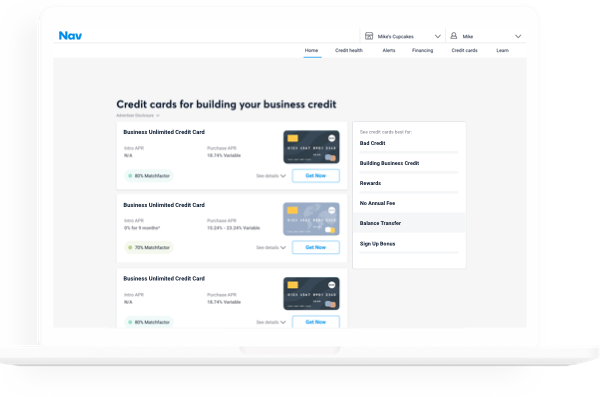

Get customized financing recommendations for your business

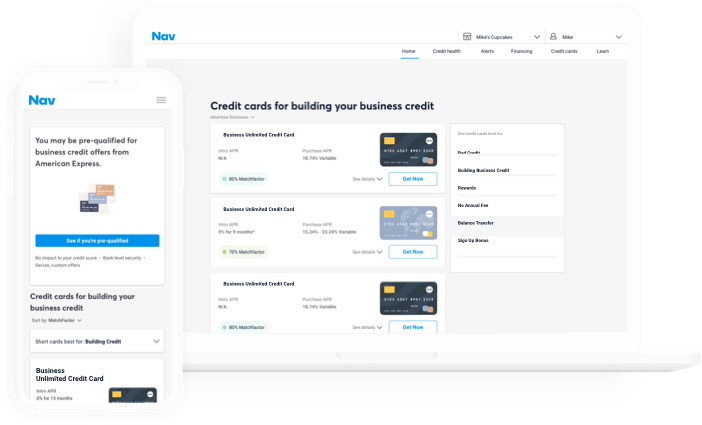

Business owners spend 30+ hours searching for financing, according to the Federal Reserve. Nav’s proprietary MatchFactor technology filters through hundreds of financing options, then reveals those you’re most qualified for so you can access capital with confidence. Nav customers who use MatchFactor are 4x more likely to get approved for a business credit card.

The largest data-driven business financing marketplace

Our marketplace has over 100 of the top business credit cards and loans all in one place, and instantly shows your financing options based on your credit and business profile. Sit back while we shop your options.

Award-winning lenders in a vetted marketplace

Nav only works with proven and trusted lenders. Our marketplace team rigorously screens all potential financing options and routinely reject lenders who don't meet our standards. Unlike many business financing sites, Nav never charges customers to connect them to the right financing.

Business owners who understand their business credit scores are 41% more likely to be approved when they apply for a business loan.

Expert help when you need it

Nav is here to help you succeed. Speak to one of our unbiased Credit and Lending Experts who can walk you through all of your financing options.

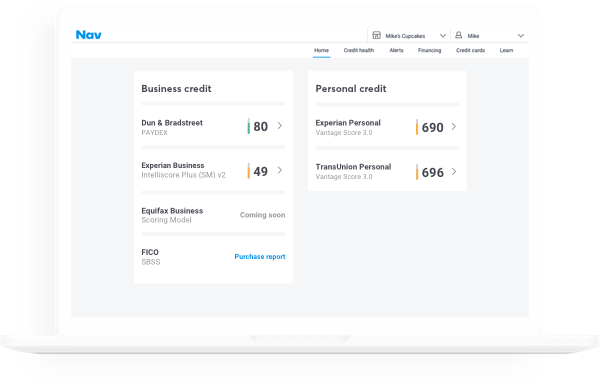

Your full credit profile —

all in one place

We're on a mission to make managing credit easier for business owners like you. With 24/7 alerts for your profiles with the major business and personal credit bureaus — Experian, Dun & Bradstreet, Equifax & TransUnion — stop wondering what's on your reports and start using them to streamline your access to capital.

Nav is the only service to have credit scores and reports from all major bureaus:

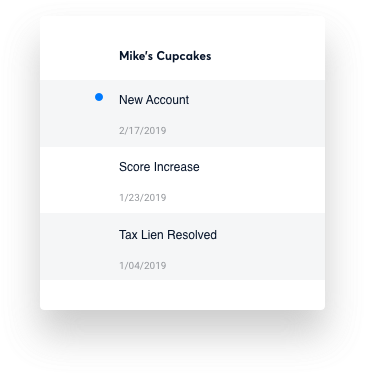

Stay up to date with real-time alerts

We monitor your credit 24/7 and alert you to any changes on your credit reports so you can avoid rejection and apply for business financing confidently. Find derogatory items (like liens and judgments) so you can dispute any inaccurate information that may be hurting your scores.

25% of business credit reports contain errors that can get you denied for financing or locked into high interest rates that kill your bottom line.

We're making business credit easier

Nav gives you a clear view of your personal and business credit scores, PLUS we connect the dots to financing. Stop wondering why you were rejected for a loan and start getting approved.

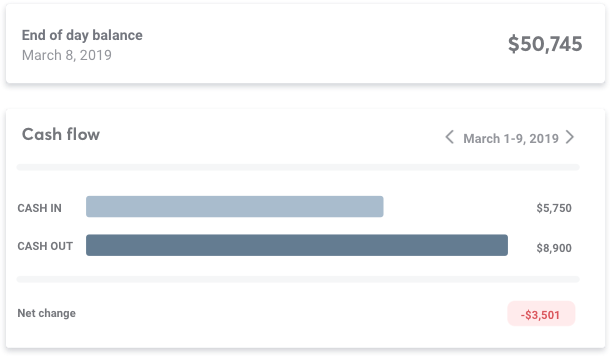

Get actionable alerts & insights

Your bank alerts aren't cutting it. Nav's machine learning technology can help you stay ahead of a cash crunch and save you money on bank fees.

-

Revenue trends

Revenue trends

-

Overdraft danger zones

Overdraft danger zones

-

Costly bank fees

Costly bank fees

Unlock new financing options

You're more than a credit score. Connecting your business bank account can unlock new financing options with innovative lenders that consider more than one three-digit number.