5 Tools That Make it Easy to Manage Your Money

If your goal is to manage your money, it can be such a stressful thing. We all know we should have a budget, should pay our bills on time, and should not be accumulating a crazy amount of credit card debt. So why do so many millennials have trouble with their finances?

According to the National Financial Capability Study, two-thirds of Millennials ( 23-35 in 2012) have at least one source of long-term debt (student loans, home mortgages or car payments), and 30% have more than one. A majority of this group report that they struggle with debt. They either have too much debt, difficulty in making payments, and they often worry about it.

So what is the deal? Why are my millennial peeps struggling this way?

I think a big part of it is not having a good understanding of the complications when it comes to money. And another is not having the right tools and resources to achieve financial freedom. I can help you on that front.

I have long accepted the fact that I am not the best when it comes to finances. So I use tools to help me where I lack the most! See my list below that will help you on your road to financial freedom.

1. Invibed Wealth Coaching

I am a huge advocate of the Invibed Wealth Coaching Program for a couple of reasons. I have learned so much in just a few weeks about finances and what is considered a good practice vs. what is not. I get these educational videos right to my cell phone every weekday morning, and I learn so much!

I’ve been surprised a few times now with some of the info I’ve learned. For example, did you know that most millennials are spending more than they earn? Neither did I!

The wealth coaching program also comes with:

- One-On-One sessions with a finance professional

- Secure Client Portal which will let you see all of your financial accounts in one place and provide your Wealth Coach with the information they need to create your Financial Game Plan.

- A 20-page Financial game plan

- Cool swag in the mail in month 6

- Email guidance from your wealth coach whenever you need it

The wealth coaching program has already been a game changer for me just because it’s like having a big sister for your finances. My finance person was understanding and did not make me feel bad for my enormous amount of debt. She actually told me mine was not as bad as what she’s seen before! If you feel overwhelmed with your finances, I highly suggest you give it a try.

Sign up for Invibed’s Wealth Coaching Program here

2. Digit.co

I suck at saving. There I admitted it. It seems the only way I save money is when I forget about it somehow. Then a friend recommended Digit.co to me, and I’ve saved more consistently than I ever have! What Digit does is take out small amounts money out of your bank account here and there.

I honestly did not even notice what was being taken it is so minimal. But on the occasion that I log into my Digit account online, I am pretty surprised at how much was actually saved.

Another thing I like about Digit is that they send me a text every day telling me how much money I have in my bank account compared to yesterday. They will even tell me the last 3 transactions if I reply ‘recent’. Just by getting this text every day I do feel more in control with my money.

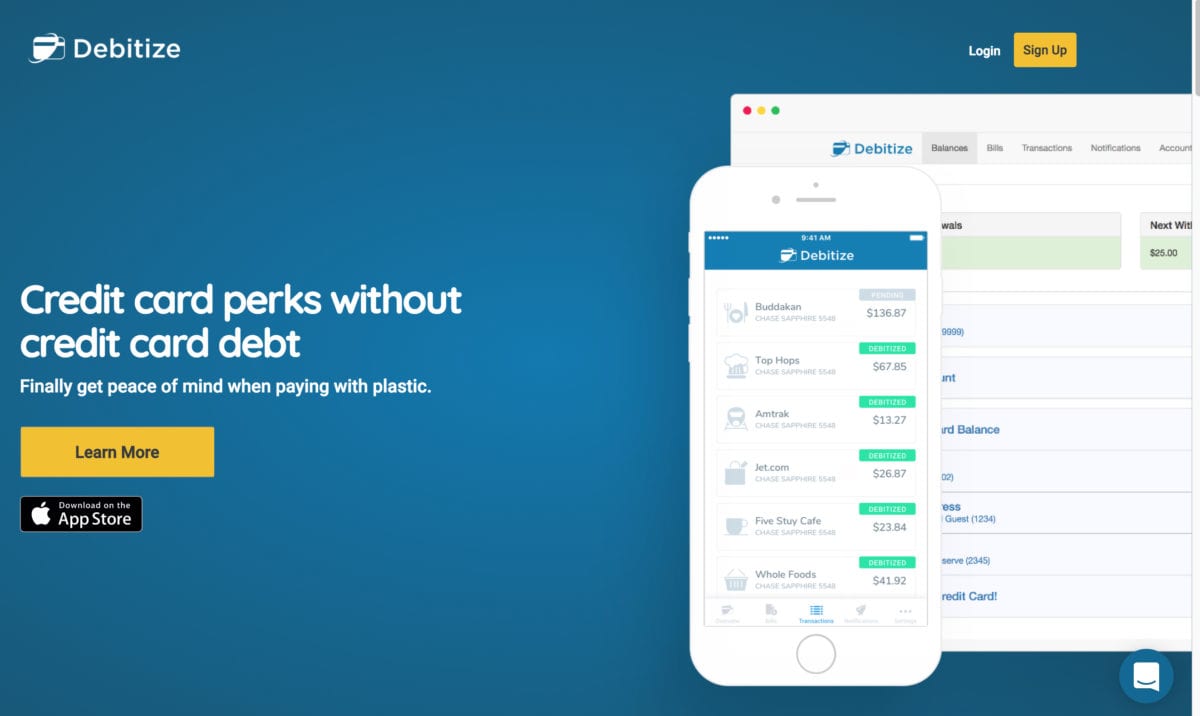

3. Debitize

Debitize has to be one of my most favorite money tools so far! If you have used your credit card before and forgot to pay it off, Debitize is a great tool for you. I heard before that one should pay all their bills with their credit card then pay the credit card off every month. This way you can accrue points, miles, cashback whatever and establish your credit at the same time.

What Debitize does is when you use your credit card, it automatically pays the balance off for you. Another feature I love about this tool is if you have credit card debt you are trying to pay off, this tool can send out automatic payments for you.

You can make a payment on your credit card every day if you’d like. Just tell Debitize how much you want to pay your bills every month and they will handle it. It;s pretty cool to see actually.

Go here to learn more about Debitize.

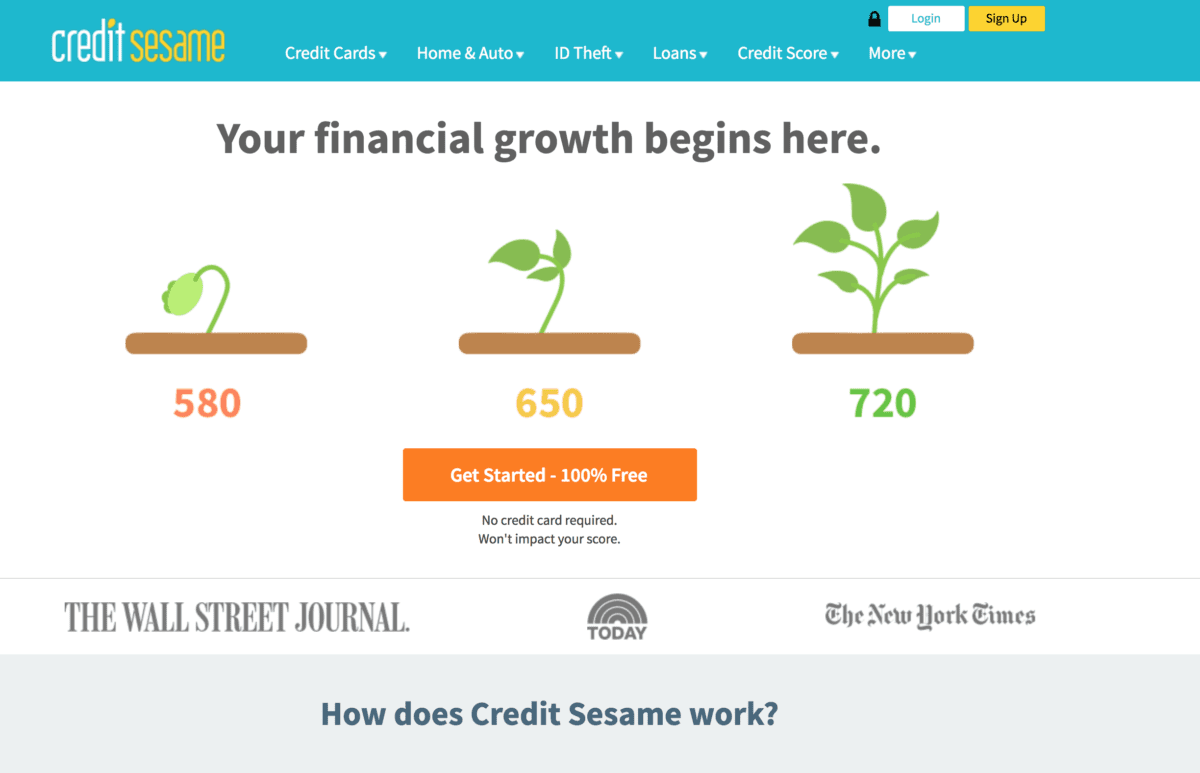

4. Credit Sesame

If you do not know your credit score, I highly suggest you sign up for a free Credit Sesame account. They can give you your credit score without putting an inquiry on your credit. They tell if your score is good or if it needs to be improved.

And my most favorite thing about Credit Sesame is they give you really good guidance on what you should do to improve your score overall.

If you are looking for personal loans, want to refinance your student loans or are in the market for a new credit card, they will also give you recommendations based on your credit score and lets you know what the chances are of you getting approved for certain loans.

If you are ready to get a clearer picture of your credit score and why your score is what it is, I highly suggest you sign up for a free account!

Sign up for a Free Credit Sesame Account Here

5. YNAB

Finally, I have a question for you. Do you have a budget? If your answer is no, then you need the YNAB (You Need A Budget) software ASAP. Their tool is pretty remarkable actually. On average people who sign up for their tool save $200 in their first month! What would you do with an extra $200?

The YNAB makes it easy to make a budget by assigning each dollar you make a job. And it’s pretty flexible on how your budget may change every month. The best part if that your first 34 days with the tool are completely free. So you have enough time to try it out and decide if it is the right tool for you.

Get your YNAB Free Trial Here.

There it is! Very simple tools that can help you manage your finances every single day. You don;t have to struggle with living paycheck to paycheck when you have all of these very helpful tools that not only make it easier to manage your money, but many automate the process for you. What are you waiting for? Sign up for these products ASAP!

Resources:

Invibed Wealth Coaching Program

The Alarming Facts About Millennials and Debt