Is It Worth It To Refinance A Student Loan?

Student loans can be a pain! And if you plan on paying yours off before you are 80, you’ve probably considered a few repayment options to pay them off faster. One of those options may be student loan refinance.

If you’ve never done refinancing, the term alone can be intimidating. So what I want to do here is walk you through the things you should consider before you decide to refinance a student loan.

What is Refinancing Exactly?

Before deciding if refinancing is right for you, we must ensure you clearly understand what it means. The phrase “refinance a student loan” means a lender pays off the student loan for you and issues you a new private loan. With this new loan, you will get a new lower interest rate.

Refinancing a student loan is not the same as consolidating a student loan since consolidating just means adding all your loans into one account with one interest rate. Unlike refinancing, consolidation does not change the loan amount or offer any way for you to save on student loan interest.

If you decide to refinance a student loan, it can go a long way because you can have a lower interest payment which means lower total payments over your loan AND lower monthly payments.

So, you could save money almost immediately by refinancing your student loans. And depending on the lender you choose, you have the potential to get some decently low rates. For example, variable interest rates for SoFi start at 2.575%, and fixed rates start at 3.375%.

You can learn more about their rates and terms here.

Who Should Refinance a Student Loan?

If you think you may be a good candidate to refinance a student loan, there are some things to consider. For example, do you have a steady income? Have you graduated from college already?

And what are your loan terms and interest rate now? Maybe, you should consider refinancing a student loan if any of the following apply to you:

- If you have federal and private loans

- You want to get a lower interest rate

- If you want lower payments each month than what you are currently paying

- If your credit score is better than when you initially took out the loans

- You are a college graduate

What Should I Know Before I Refinance a Student Loan?

So you may be considering refinancing. Great! Here are a few things you need to have ready.

Credit Score

You should have an idea of what your current credit score is before the refinancing application. But this part is easy. Just go to a site like Credit Sesame to get your credit score.

It is free to do and will not adversely affect your credit score. Plus, you should have a good idea of what your credit score is at all times, and Credit Sesame does an excellent job of telling you when it has changed.

It’s good to have a site like Credit Sesame, too, since it allows you to keep an eye on your credit history just in case someone steals your identity or charges something you did not buy using your credit cards.

Employment Income Information

You must state how much income you bring in annually to apply, so have a pay stub or tax return handy if you do not know this number.

College Graduation Information

If you are still in college, the odds of qualifying for student loan refinancing are slim to none. So make sure you have your college graduation dates handy. If you are a parent who took out loans to help your children go to college, you may consider refinancing Parent PLUS loans.

Your Current Loan Information

Your current loan information is probably one of the most important things to know since you need to know how to improve your situation. For example, if you are already paying a 2.00% interest rate for your student loans (lucky you if this is the case), then chances are that getting a lower rate than you are already paying may not be of much use to you. So get an understanding of how much more you owe and what is your current interest rate before applying.

If you have all this stuff ready, you can apply to refinance your student loan! But first, let’s chat about who should not be refinancing their student loans.

Who Shouldn’t Refinance their Student Loans

You may want to rethink refinancing your student loans if any of the following apply to you:

- Are you a teacher or some other professional who could qualify for student loan forgiveness

- If you use income-driven payment plans or use forbearance or deferments. (However, SoFi does offer a forbearance program for three months to a year but does not offer income-driven payment plans for you.)

- You do not have a stable income

- If you are still a student

Where do I go to sign up?

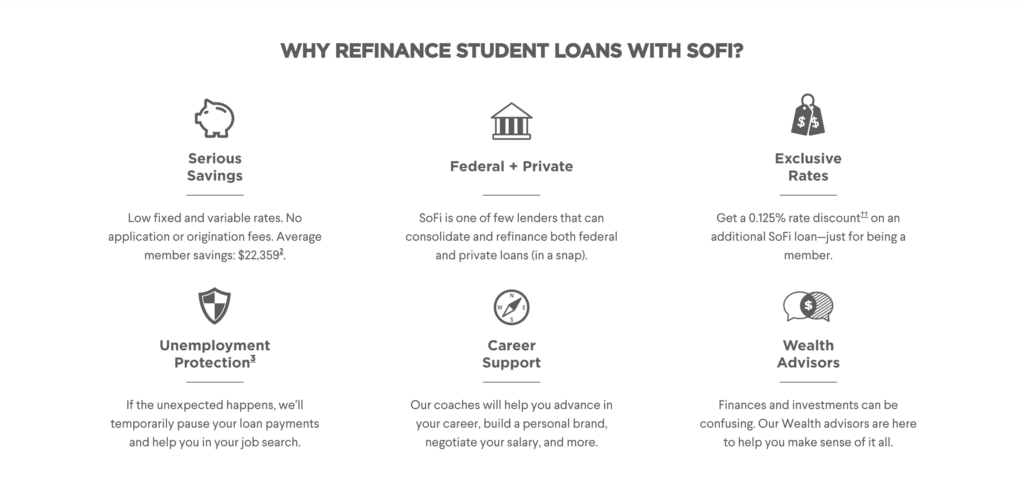

While many student loan refinancing lenders are out there, I have been very impressed with SoFi.

SoFi, also known as Social Finance, is a finance company that believes in saving you money. Not only do they do student loan refinancing, but they do personal loans, mortgage loans, and life insurance and they will even manage your stock portfolio.

Regarding their student loan refinancing plans, they have the lowest rates I’ve seen regarding variable rates, and they go above and beyond compared to some other lenders out there. For example, if you lose your job, they will pause your loans for you for up until a year until you are back on your feet again.

And they have career and wealth advisors you can chat with on the phone to help you better finances. Mind you; these advisors do not cost you anything extra. The wealth advisors are available to anyone using their loans!

SoFi will even give you discounted rates for their other loans if you take out a personal or parent loan later.

They even claim that their members save an average of $288 a month and a total of $22,359 when they work with them, which sounds incredibly promising.

All-in-all, SoFi gave me the warm and fuzzies because they show they care about the customers and offer a much-needed service to millennials drowning in student loan debt! There are no origination fees or prepayment penalties, and they aim to save you as much money as possible! You can check your personalized rates online in just 2 minutes by going to the link below.

Click here to check your student loan refinancing rates!

Student loan refinancing is not an option for everyone, but it can be an option for many that could save you a lot of money. It is worth doing a little research since you can save $200+ a month! Has anyone here ever refinanced a loan before? Let us know about your experience in the comments.

Resources

Refinancing 101: Should You Refinance Your Student Loans?

4 Things to Think About When Refinancing Student Loans