On Your Own as a Debt-Free Young Woman: Why it Makes for a More Passionate, Happy Life

So, you’ve probably heard all the hype about running up personal debt—how, at the end of the day, it’s bad news. And even thought it seems like everyone is doing it—using credit cards to pay for clothes, trips, living expenses and more—it takes a toll on our well-being, our self-esteem and certainly on our relationships.

You may have even heard that debt-pressure is one of the top stressors in marriages, and that money trouble can topple a partnership faster than just about anything else.

Debt is hard on the heart for one simple reason: when we buy things we can’t afford on credit, we end up gouging our living expenses cash later to pay off the debt. And since credit use comes with added interest, that means we end up paying a big chunk more for that sweet, stylin’ shirt or those groovy platform shoes than they cost in the first place.

We end up feeling crappy about ourselves—we feel guilt, shame and remorse that we boxed ourselves in financially and can’t seem to make sense out of our money. Debt does that to us—it’s never any fun.

Though while you’re in high school, you’re not usually having to think about footing the bills, soon, in your young adult life, you will be. There will be things you need to fund every month, and things you want to fund.

So let’s take this apart more specifically. Let’s say you bought a shirt on a credit card for $75.00, and there’s 18% interest on the card. That means you pay at least 18% more than your $75.00—or $88.50—but, if you keep that balance over time, or add to it, the interest keeps going up. 18% of $3,000 is a much bigger debt-ticket.

Paying more for our stuff is only half the trouble. At first we may only be carrying a small balance on credit cards from “splurging” on clothes or dinners out, but credit is like the dark chocolate-chip fudge ice cream in the freezer: it keeps calling to you, until suddenly you’ve finished the whole pint and you’re a bit nauseous. You know it’s not good for you, but you keep doing it.

Suddenly you can’t pay for your bills and daily needs without struggling. You’re behind the 8-ball with your money. And if something happens—like the carburetor goes out on your retro-Mustang—then you’re in more trouble. You’re putting more money on your cards now, and digging yourself a deeper hole.

So how does a savvy girl get ready for that ‘on-your-own experience’ as a debt-free, financially-smart young woman?

First, don’t start running up debt. “Well that’s a great thought,” you might be thinking, “but how on earth do I do that, when I’m going to have expenses every month on an entry level salary?”

Here’s how. Start thinking about how to plan your expenses now. Keeping track of what you spend after the fact is way too late. You’ve got to plan. And know this now: using a Spending Plan takes just a few minutes a day—it doesn’t have to consume your life.

So, divide your money into three categories: 1) Bills (rent, cell phone, utilities, etc.), 2) Daily Needs (food, fuel, beauty, postage, clothing, etc.) and 3) savings and fun money.

Here’s our goal: 1) to pay our Bills on time, 2) to fund our Daily Needs with ease, and 3) to set aside some money for the usual stuff that happens in any year of being alive as well as some money for stuff that’s meaningful to us.

So let’s get down to brass tacks: If we’ve got $3000 to live on after our taxes are taken out of our paycheck, then how much goes to each thing? If our rent and bills cost us $2,000 a month, then our Daily Needs and Savings/Fun Money can’t add up to more than $1,000 a month, right?

That’s how you do it. You PLAN for what you have in each category. If your Bills cost $2,000, and you put $200 aside for savings and fun, then do the math: you’ve got exactly $800 for all your Daily Needs categories. You’ve got to massage the numbers until they fit. Let’s look at an example in a list:

Food $300

Fuel $280

Beauty $20

Postage $10

Laundry $20

Cleaners $20

Copays $15

House $15

Clothes $40

Gym $80

$800

What this means is that you won’t be racking up $200 a week grocery bills at the local swanky food store. You won’t be in the market for a $275 haircut. But you can still live well without credit. You simply look for places to get your needs met less expensively. Blow dry bar not in your Spending Plan? No problem. Use the beauty school for $6 or $10 and fit it into your Plan. Massage not in your Plan? Fine—use the massage school for $34 and put it in your Plan.

The premise is simple: when you live within your means—even if your paychecks are small at first—you keep the stress out of your life and your heart. When you plan what you can spend in each category, you keep the money you set aside for yourself for fun, travel or whatever else you love. You’re not randomly going over your cash income with a $300 mindless spree at Target.

And without all that debt-stress, you’ll be free to spend your time and energy on things that you love. You might live a bit simpler than your friends who are running up debt, but you won’t have any of their angst, guilt or money-stress. Also, when you get into a relationship, you won’t have money baggage.

Every time you buy something, you’ll have simple clarity about how much you have to spend before you spend it.

Living debt-free means freedom: you are not boxed in by credit card bills, and you’re free to choose how you want to spend your time, your energy and your talents. Your life becomes about who you are and not what you owe. You get to live more passionately.

And that, for every young woman on her own, is worth its weight in gold.

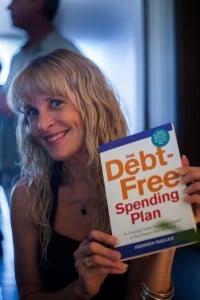

Want more advice? Check out Joannaeh’s book the Debt-Free Spending Plan here.