3 Reasons More Women Are Investing In Precious Metals Since The Pandemic

Boring Money estimates that only 40% of UK investors are female, which could mean they are missing out on £599 billion through the gender investment gap. This gap can hugely damage individuals, families, and the broader economy.

There is still work to be done. However, recent research from BullionVault suggests that the gap regarding precious metal investing is reducing, with a 116% increase in new female investors on their platform since 2020.

Why has there been an increase?

This increase in female precious metal buyers within the BullionVault platform could indicate an increase in women diversifying their investment portfolios. Buying gold, in addition to other precious metals, can protect against inflation while also balancing your risk, with gold historically being a relatively good hedge against periods of lower performance in shares, bonds, and real estate.

This increase is interesting, as it comes in contrast to the general investment gap between men and women as Holly Mackay, CEO of Boring Money, states:

“The gender investment gap remains stubbornly and frustratingly high and will worsen in 2024. Shockingly, it’s higher than the GDP of Poland or Argentina.”

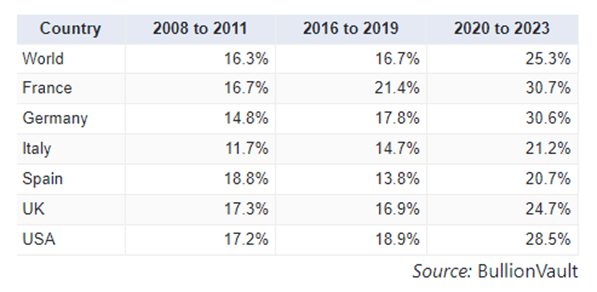

The data to the right, which shows women as a percentage of new precious metal investors, shows the trend is global, not just in the UK.

How do we progress financial empowerment?

The data shows that in terms of general investing, the gender gap is still significant, but work can be done to reduce this over time.

Investment in women-focused financial products: Develop and promote investment platforms specifically designed for women, like Ellevest, that acknowledge their unique financial goals and challenges and can help us facilitate informed investment decisions and wealth building.

Networking and mentorship: Through fostering networks and mentorship opportunities through organizations like Lean In, we can provide women with the community support, guidance, and connections necessary to advance their careers, entrepreneurial endeavors, and investing journey.

Why does the investment gap matter?

The investing gap exists; the data from Boring Money quoted in the FT suggests that women may lack confidence when putting Money into the markets, favoring cash savings.

According to Vanguard, the average inflation-adjusted rate of return for stocks and shares was 5%, with cash at just 1%. More proactive investing with precious metals in the mix could also help close the gap, which is a positive for both men and women.